One of these themes is the importance of having multiple streams of income. When you ask the ultra-wealthy their secrets to financial success, their answers will vary, but a few themes pop up consistently. Whether or not you accept the word “passive” to describe this mechanism, what matters is that it can have a phenomenal impact on your financial life. The goal, in either case, is to establish a system that continually pays you money even while you follow other pursuits. In this light, residual income is what most people mean when they bring up passive income.Īlthough residual income is not always entirely passive, the two ideas are primarily the same. Though we can all agree that there is no way to create a source of income from nothing, some argue that the push behind passive income misleads people into subconsciously believing it. Critics say there is no such thing as truly passive income since all income sources require some form of initial input. However, with widespread attention comes scrutiny, and the concept of passive income is no exception. Passive income has become something of a holy grail in personal money management - build up income streams that pay you passively, without you needing to work to continue earning. Understanding residual income may remind you of a similar term with much better brand recognition: passive income. However, this is not the definition we’re focusing on today. They may use this metric to judge someone’s ability to make loan payments, among other purposes. In banking, professionals may use residual income to describe someone’s remaining or disposable income after covering their essential bills and necessities. Dividends, bonds, and other forms of income investing.Licensing, such as through a patent or trademark.There are many ways a person can earn residual income, including: Others will last for a fixed period or as long as certain conditions are met.

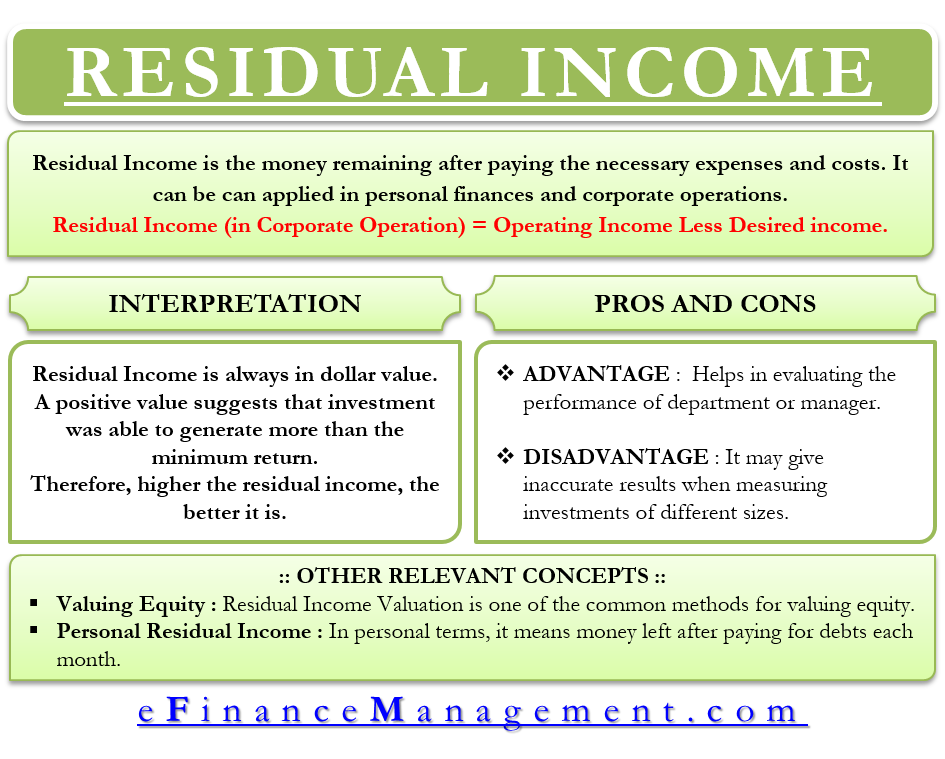

Some streams of residual income will continue providing income indefinitely. But on the other hand, the residual income you earn from past work or investments will continue paying for a period of time after you stop actively contributing to it. Residual income streams typically continue to provide money even with no additional input from the owner.įor instance, if you quit or stop showing up to your job, you will cease making the active income it provides. Residual income refers to continuous cash flow that persists after an initial investment of time, money, or other resources. This powerful financial tool, which people often confuse with passive income, could be an excellent way to grow your earnings and improve your capacity to build wealth.

A bi-weekly paycheck for two more weeks at your job is always a welcome sight, but what if you could get the same result without putting in a fresh 40+ hours each time? Money that keeps paying out long after you stop working may sound like a fantasy, but that’s the reality of residual income.Ī common source of revenue for profitable businesses, residual income is something that regular people can access, too.

0 kommentar(er)

0 kommentar(er)